Your Trusted Partner For

Business Credit & Loans

Building a successful business in Northern Virginia takes more than passion. Based in Sterling, VA, VIP Business Credit helps entrepreneurs unlock growth & protect assets.

95%

Businesses funded

10+

Credit lines unlocked

40%

Avg approval increase

Why Choose VIP Business Credit?

We combine expert guidance with proven strategies to help you build credit and

secure funding the right way.

Exclusive Access

Connect to 1,000+ national and local lenders, including options tailored for Virginia businesses.

Personalized, Concierge Guidance

Our local Business Credit Advisors guide you step-by-step, so you never face funding roadblocks alone.

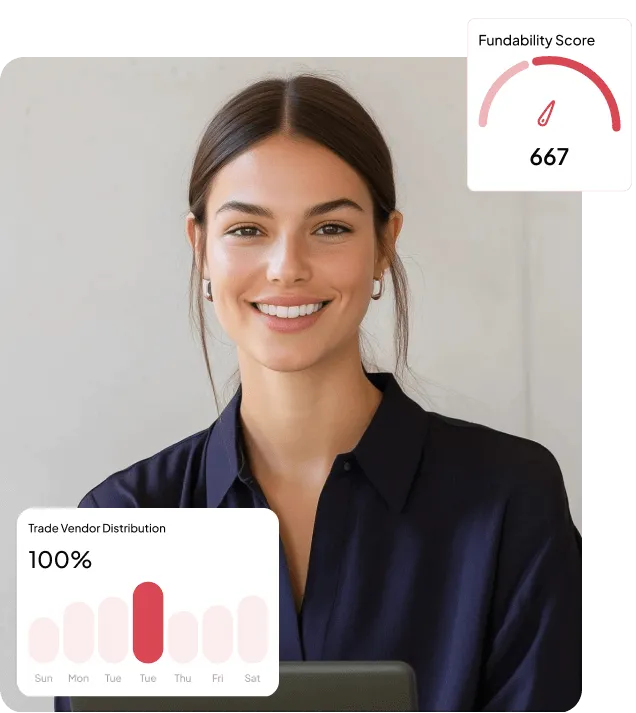

Proprietary Tools

Only VIP Business Credit offers the Fundability Score see how lenders view your business and uncover hidden path

Why Build Business Credit?

Business credit determines how lenders evaluate your company—

not your personal finances.

Higher Credit Limits

Negotiate flexible terms and improve cash flow with trusted suppliers.

Lower Interest Rates

Strong credit helps you qualify for lower borrowing

costs.

Better Supplier Terms

Secure more flexible payment terms from

suppliers.

Greater Financial Flexibility

Gain the freedom to manage cash flow and seize new opportunities.

Our 4-Step Path to Business

Credit & Funding

A clear, guided approach to building credit and accessing the right financing options.

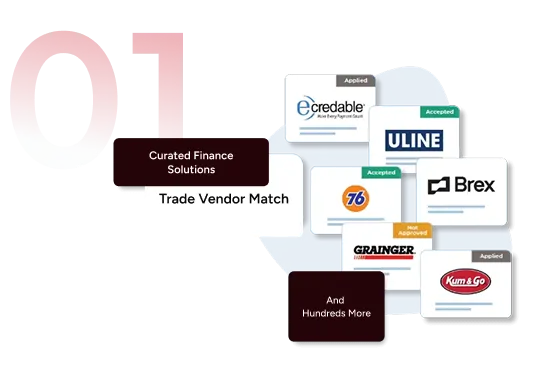

Business Credit Setup

Discover what you qualify for today and how to improve your rates, terms, and access larger funding.

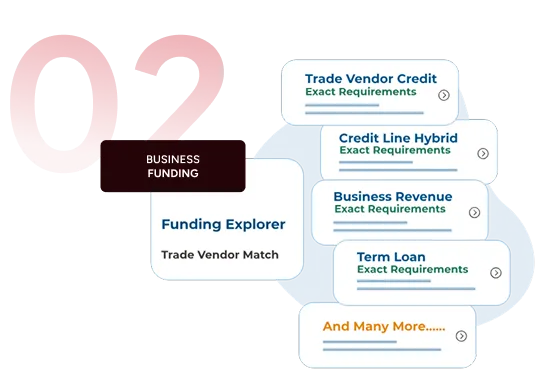

Find the right business loan

Funding Explorer shows all available business loans at a glance and highlights the programs you qualify for.

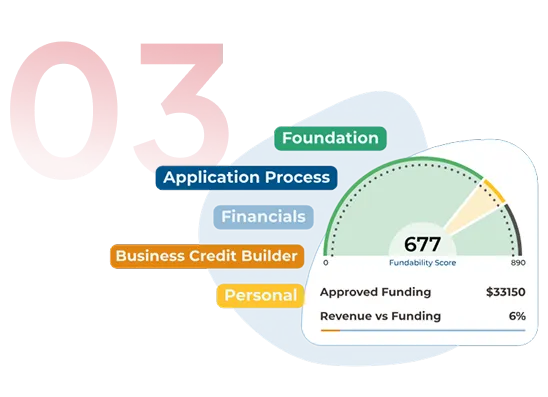

Know your Fundability Score

Fundability is the only software that integrates with lenders' secret credit reports and key factors to generate a Fundability Score™.

Track & manage business credit

Discover what you qualify for today and how to improve your rates, terms, and access larger funding.

What Our Client Say

When difficult emotions are met with loving attention, everything shifts.

Here is what that shift looks like in practice.

Empowering Virginia Businesses With Strategic Solutions

Ready To Take Your Business To The Next Level? Spots for local, one-on-one business credit consultations are limited Take action now to reserve your place.

Building a successful business in Northern Virginia takes more than passion.